When booking a car, rental counters often insist: “Would you like to add insurance?” It’s easy to feel pressured—but many common beliefs about rental car insurance are outright myths. Let’s debunk them and help you make a clear, cost-effective decision.

🔎 Myth 1: Your Personal Insurance Always Covers Rentals

Many renters assume their standard auto insurance fully covers rental cars. In reality, while some policies include limited cover, it depends on your provider and circumstances. Most personal policies may cover liability, but not collision, theft, or loss-of-use charges—and they often exclude rentals abroad or across certain states.

What to Do:

Check your policy or contact your insurer before relying on it. If you rent while visiting or plan to drive through remote regions, read the terms carefully.

Myth 2: Credit Card Coverage Is Enough

Yes, many credit cards include rental car cover—but often under strict conditions: you must pay with that card, decline the provider’s coverage, and be renting in eligible regions. Even then, credit card protection rarely covers liability, damage to windscreens or tyres, and often excludes domestic rentals.

What to Do:

Check the card’s policy and remember: third-party or excess coverage usually isn’t included.

Myth 3: You Must Purchase Insurance from the Rental Desk

This is a hard sell tactic used by many providers—even if your personal insurance or credit card already provides adequate coverage. In many cases, buying at the counter is unnecessary and significantly raises costs.

What to Do:

Arrive informed—know your coverage and decline duplicates. Consider buying excess cover in advance from a third-party insurer.

Myth 4: “Full Insurance” Means You’re Covered for Everything

No insurance is truly “full” or comprehensive in the fullest sense. Many plans exclude damage to windscreens, tyres, roof, underbody, or unauthorised use like driving off-road or letting unlisted drivers take control.

What to Do:

Always read the Product Disclosure Statement (PDS) or policy details to understand exactly what is—and isn’t—covered.

Myth 5: You Don’t Need Insurance If You’re Not at Fault

While the at-fault driver’s insurance typically covers damages to third parties and vehicles, it may not cover admin fees, loss-of-use charges, or emergency costs imposed by the rental company.

What to Do:

Consider excess reimbursement or supplemental coverage to reduce or waive your liability—even if not at fault.

Myth 6: Insurance Always Covers Loss of Use

Loss-of-use fees compensate the rental company for revenue lost while the car is under repair. Many standard policies—both personal and credit card—do not cover these charges, which can reach hundreds per day.

What to Do:

Confirm loss-of-use is included, or buy coverage that specifically addresses it.

Myth 7: Anyone Who Insures Can Drive the Car

Wrong. Most rental insurers require all drivers to be named on the contract. If someone not listed drives and there’s an incident, your cover may be invalidated.

What to Do:

Add all drivers upfront, even if it incurs a small fee.

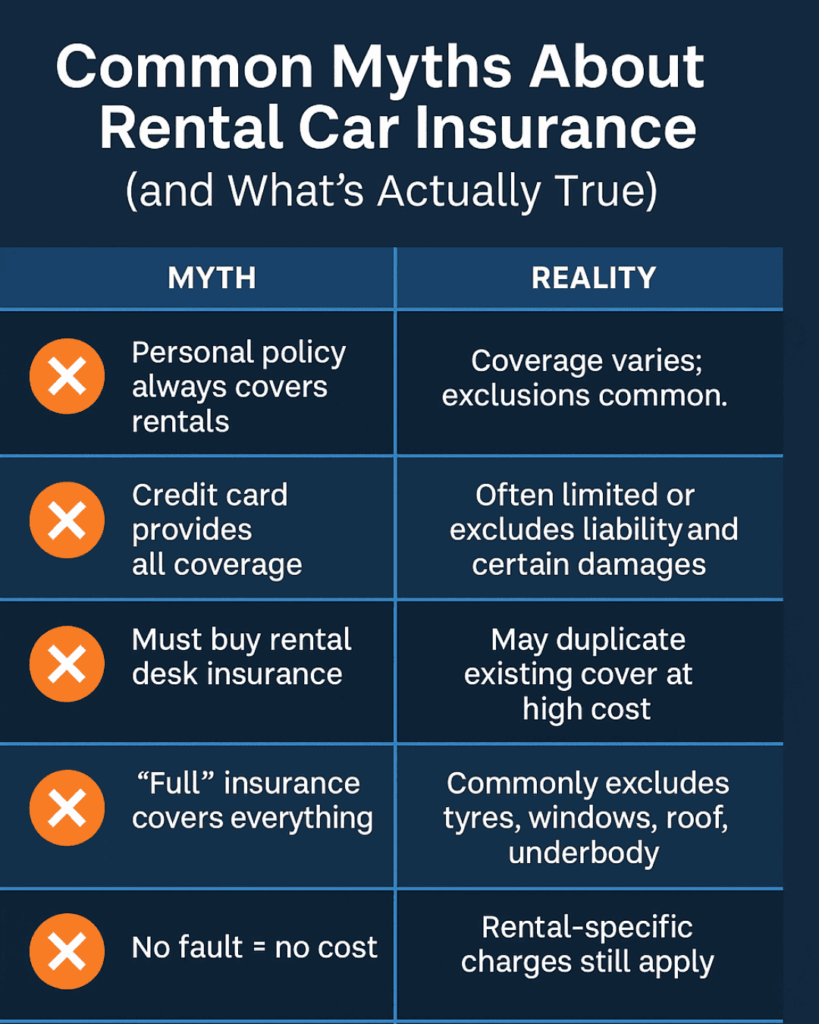

Myth Overview Table

| Common Myth | Reality |

|---|---|

| Personal policy always covers rentals | Coverage varies; exclusions common |

| Credit card provides all coverage | Often limited or excludes liability and certain damages |

| Must buy rental desk insurance | May duplicate existing cover at high cost |

| “Full” insurance covers everything | Commonly excludes tyres, windows, roof, underbody |

| No fault = no cost | Rental-specific charges still apply |

| Loss-of-use is always covered | Usually not included; claim separately if needed |

| Any insured driver can drive | Must be listed on rental agreement to maintain coverage |

How to Make an Informed Choice

1. Check Your Current Cover

Review your personal auto insurance, travel insurance, and credit card benefits. Compare limits, geographic validity, and exclusions—especially for tyres, windscreens, roof, and off-road damages.

2. Review Rental Terms

Rental agencies often include Compulsory Third Party (CTP) and basic liability by default in Australia. But Collision or Loss Damage Waiver (CDW/LDW) usually comes with a high excess unless reduced at extra cost.

3. Purchase Third‑Party Excess Insurance

Third-party policies often offer broader coverage—including windscreens, tyres, towing costs, admin fees—at lower, upfront rates. Just ensure they’re recognised by your rental provider and you can claim reimbursement.

4. Inspect and Document the Vehicle

Take timestamped photos or video of any pre-existing damage before driving off. This helps avoid disputes and denied refunds later.

5. Understand Breach Conditions

Insurance is void if you breach rental conditions—like driving under the influence, using unsealed roads, refuelling improperly, or using unauthorised drivers.

6. Plan for Your Destination

If you’re driving off-road, in the outback, or interstate in Australia, standard policies may not suffice. Consider bespoke cover when hiring a site or mine-spec vehicle.

Make Your Experience Easier

- Learn about our vehicle insurance options during hire

- Explore our site and mine-spec fleet ideal for high-risk areas

- Check insurance add-ons on our standard vehicle hire pages

- Understand one-way travel pitfalls on our one-way hire terms

Final Thoughts

Many misconceptions about rental car insurance can lead to overpaying or being undercovered when you most need protection. By understanding these myths, reviewing your existing coverage, and choosing carefully—whether at the rental desk or beforehand—you can drive confidently and economically.

At Trend Car Rentals, we provide transparent insurance options with our fleet, from 4WDs to minibuses. Contact us or book online with clarity and peace of mind.